Backtested Performance

Jan 2018 – Jan 2026 (partial) • S&P 500 Stocks • 2% Position Sizing • 2x Leverage

$1M Investment Growth

Performance vs Market Benchmarks (2018–2026)

Full comparison against unleveraged and leveraged market exposure

| Metric | Our Strategy | SPY (1×) | SPY (2×) |

|---|---|---|---|

| CAGR | 24.77% | 13.17% | 23.45% |

| Max Drawdown | −19.56% | −33.40% | −57.71% |

| Volatility (annualized) | 18.46% | 16.78% | 33.96% |

| Sharpe Ratio (monthly) | 1.09 | 0.59 | 0.68 |

| Total Return | +466.7% | +157.1% | +394.1% |

Note: SPY (2×) shown as a theoretical leveraged benchmark. Strategy equity is based on realized PnL only; SPY is mark-to-market. The strategy delivers similar returns to 2× SPY with 66% lower volatility and 66% smaller drawdowns.

Year-by-Year Performance

| Year | SC Equities | SPY | Difference | Winner |

|---|---|---|---|---|

| 2018 | -4.77% | -7.16% | +2.39 pp ✓ | SC Equities |

| 2019 | +35.76% | +30.66% | +5.10 pp ✓ | SC Equities |

| 2020 | +59.22% | +15.15% | +44.07 pp ✓ | SC Equities |

| 2021 | +44.33% | +28.65% | +15.68 pp ✓ | SC Equities |

| 2022 ⭐ | +8.38% | -19.79% | +28.2 pp ✓✓ | 💎 BEST YEAR |

| 2023 | +20.25% | +24.77% | -4.52 pp ✗ | SPY |

| 2024 | +40.22% | +24.13% | +16.09 pp ✓ | SC Equities |

| 2025 | +1.96% | +16.50% | -14.54 pp ✗ | SPY |

| 2026 (Partial)* | +2.38% | +1.42% | +0.96 pp ✓ | SC Equities |

| Average (CAGR) | 24.77% | 13.17% | +11.60 pp advantage | |

💡 Key Insight: Downside Protection

Systematic Contrarian Equities outperformed in 7 out of 9 years. The strategy's biggest advantage came in 2022's bear market (+28.2 pp advantage), demonstrating exceptional downside protection when capital preservation mattered most. While SPY fell -19.79%, we stayed positive at +8.38%.

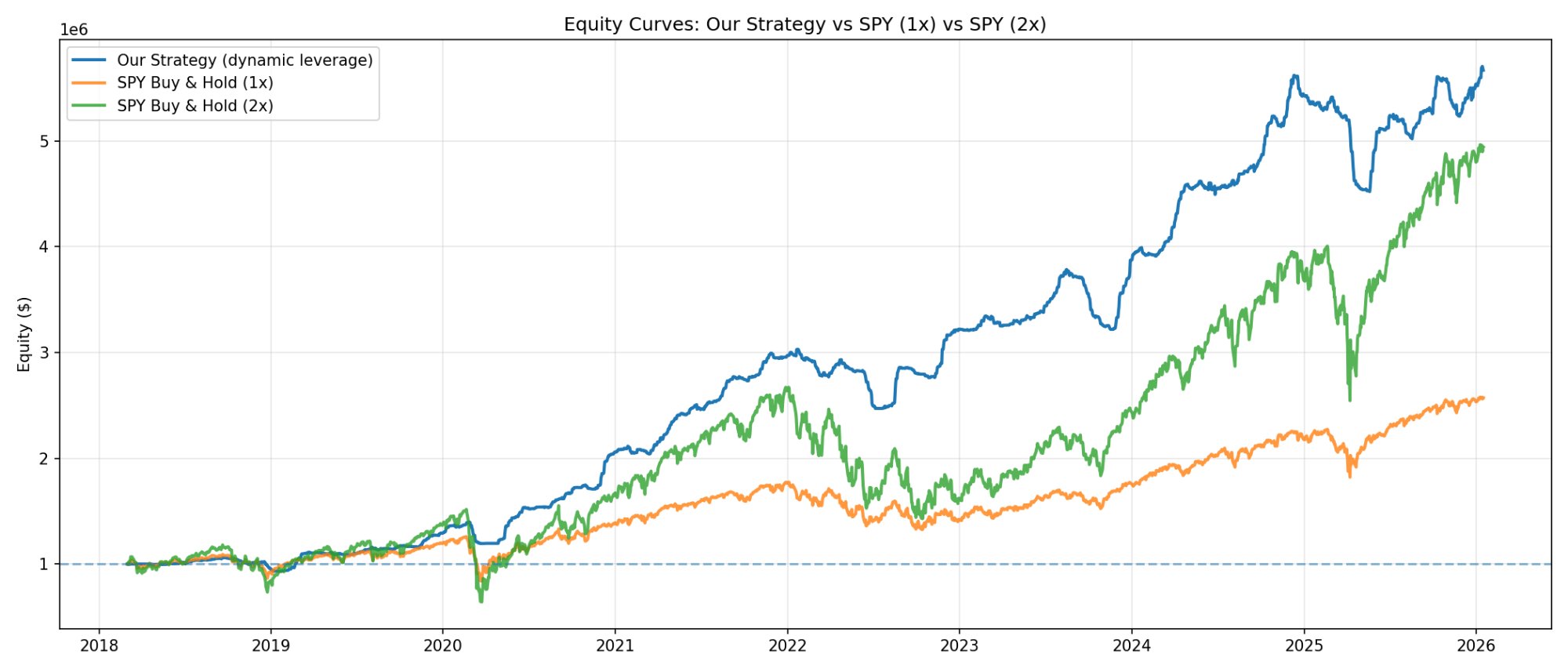

Equity Growth: Strategy vs SPY (1×) vs SPY (2×)

Visual comparison showing how $1M grows across different approaches over 8 years

Key insight: The strategy compounds capital through selective exposure, while leveraged SPY experiences large drawdowns during market stress. Our approach delivers similar returns to 2× SPY ($5.67M vs $4.94M final value) but with dramatically smoother growth and 66% smaller peak drawdown.

Risk Is Managed — Not Eliminated

Drawdowns are a function of realized losses only. Unrealized volatility is not smoothed or hidden.

Our Strategy

SPY (1×)

SPY (2×)

Key insight: The strategy delivers similar returns to 2× leveraged SPY (24.77% vs 23.45% CAGR) but with dramatically lower drawdowns (-19.6% vs -57.7%). This demonstrates capital efficiency through selective exposure, not permanent leverage.

Important Performance Disclosures

- • Backtested results ≠ future results. Past performance does not guarantee future returns.

- • All results shown are simulated using historical data with STEP PnL methodology (Signal-To-Execution-Point).

- • Real trading involves slippage, commissions, and execution risk not fully captured in backtests.

- • Leverage amplifies both gains and losses. 2x leverage means 2x exposure to market movements.

- • Results assume reinvestment of all returns and no withdrawals during the period.

- • Individual results may vary based on account size, entry timing, and market conditions.

Ready to Start?

Connect your broker and let the strategy work for you.

Connect Broker →Non-custodial • Cancel anytime